About REIT

What is a REIT – Real Estate Investment Trust

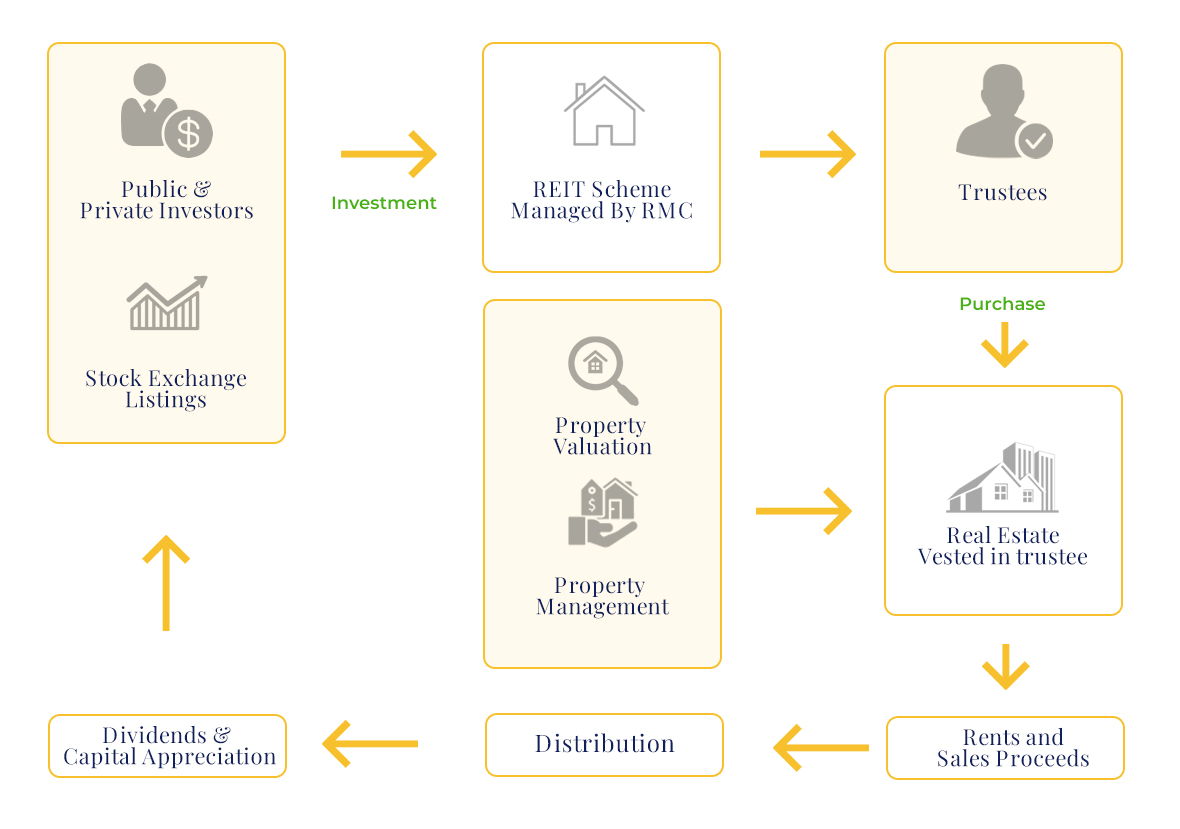

A Real Estate Investment Trust (REIT) is a company that owns or finances income-producing real estate. REITs are like mutual funds. REITs provide investors of all types with regular income streams, diversification, and long-term capital appreciation. REITs allow individuals to invest in real-estate properties in a similar way you purchase a share of a company.

A REIT collects a pool of money (from individuals and institutional investors) to buy real estate. The Unit holders of a REIT Scheme earn a share of the income produced through renting or selling the real estate property without actually having to bear the hassle of buying or managing the property on their own.

RMC Rating: AM2+ (RMC) by JCR-VIS Credit Rating Company